Advanced Corporate Finance

The capital markets are in upheaval. More and more and ever greater crises in our hitherto purely growth-oriented economic system are making a consistent change of course unavoidable. The restructuring of the world financial system is currently in full swing based on ESG criteria, the abbreviation standing for “Environmental, Social, Governance”. Led by the world’s largest investors and asset managers, such as Blackrock or Vanguard, nothing less than the most comprehensive and fastest economic restructuring in human history is imminent. With effects on everything and everyone.

From now on, those who do good will be financed. For the climate and thus for the inhabitants of our planet. And demonstrably on the basis of verifiable data and facts – the ESG criteria. In concrete terms, this means that the worse my impact rating is in the future, the more expensive and difficult my financing will be. Even to the point of being unfinanceable. This spells the end for industries that cannot be restructured. The phase-out of coal, oil and other fossil fuels in favor of renewable energies is just one example. Against this background, we need a different way of thinking. And with it the development of creative, new ideas for corporate finance. That is what we offer you. Welcome to Mensalia Advanced Corporate Finance.

Read more

Toggle AccordionSigns of an incipient climate catastrophe can be seen in many places. Not only in the form of melting glaciers. Or thawing permafrost. Extreme weather events affect us very directly. In extreme cases, they can make entire regions of the world uninhabitable. Instability, unrest and even wars, as well as hunger and migration are the consequences. Oceans full of plastic waste will no longer feed us. The ongoing destruction of rainforests and other valuable natural habitats is destroying biodiversity in favor of monocultures. This in turn favors the outbreak of new diseases and pandemics. As a result, more and more new crises are bringing our economic system, built solely on growth, to its knees. A restructuring with inevitable warping and slipping. Ultimately, it is about a complete reorientation of world finance along ESG criteria.

ESG Finance

From its inception, and in a comparatively short period of time, our ESG Finance product has earned a good reputation with the financing of ESG projects. Particularly in the field of experimental industrial research&development, but also in tourism, the maritime industry and transportation. As a financing boutique, our capacities are naturally limited. On the other hand, our clients benefit from first-class support when we take on a mandate.

ESG Investments

You have a medium-sized company or you are a founder. Now you are looking for investors or financing partners for your ESG project or your company. We are happy to support you with fundraising, i.e. the search for investors. At fixed prices or on a retainer basis with a success component. You benefit from the know-how of more than 20 years of investor relations in the capital market of the DACH region. In addition, we act as ESG investors ourselves on a case-by-case basis. If an alignment of interests is ensured, we also approach potential co-investors after our own positive entry decision. As investors, we are currently fully committed until around the beginning of 2022. However, exceptions confirm the rule. For SMEs, reorganizations or start-ups, as well as on a case-by-case basis for group projects, we will continue to be at your disposal as advisors and intermediaries at any time.

ESG Digitals

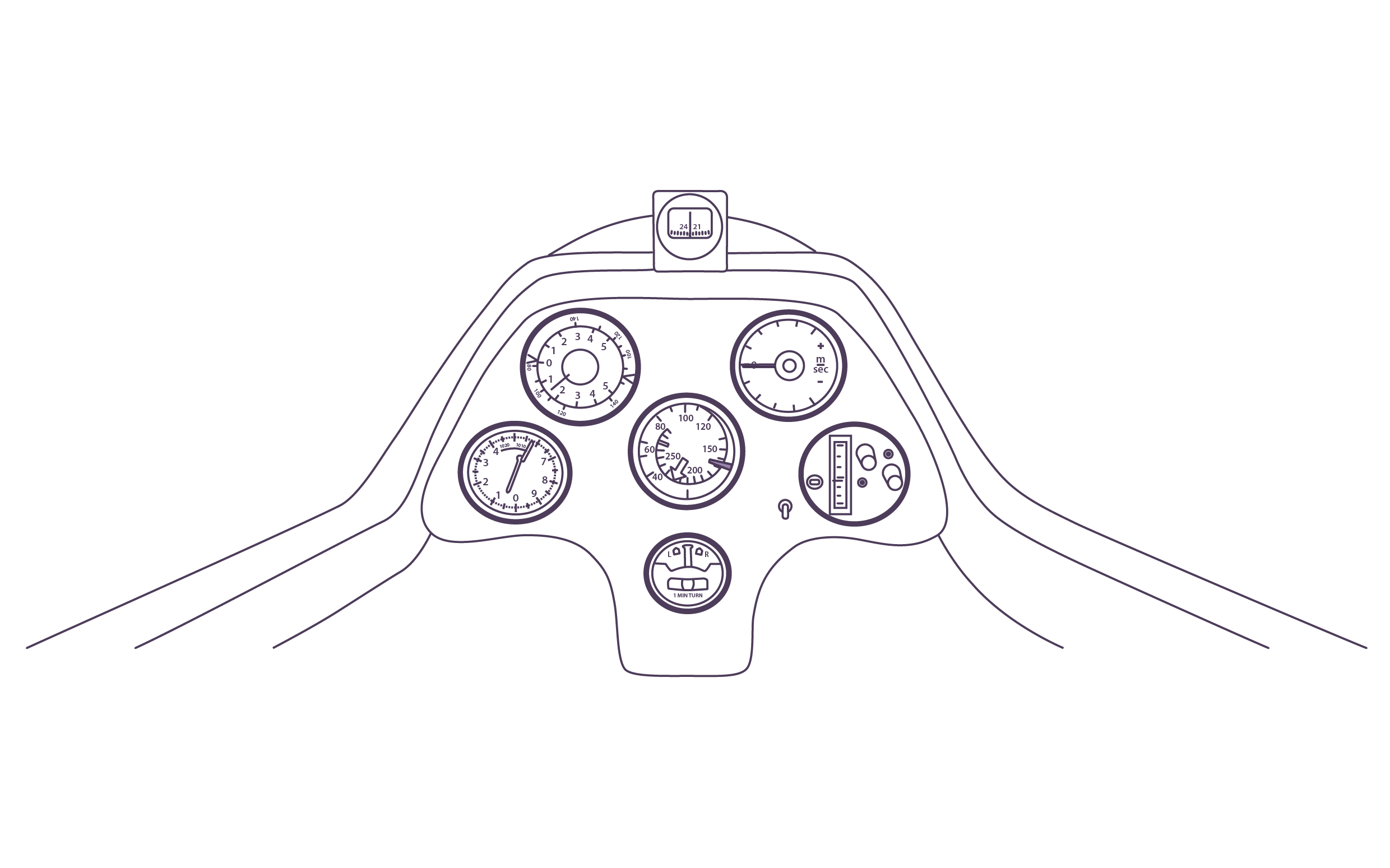

ESG-Cockpit

Sustainability is not a matter of opinion. Sustainability is measurable. With ESG-Cockpit, our state-of-the-art system for your sustainability management, at the push of a button you obtain data on your performance for important non-financials such as emissions, HR, or resource consumption. Manage your sustainability data with state-of-the-art ESG data consolidation technology. For your controlling and for your internal and external reporting. For certifications as well as proof for rating agencies to obtain attractive financing.

Are you ready for the digital quantum leap in ESG data processing? If so, we look forward to hearing from you.

Initial difficulties in collecting NFI key figures? Turbulences when analyzing CRS data? We provide you with the right tools. Let’s make your CSR reporting take off!

Key advantages

Toggle Accordion- High usability saves time in application

- Flexible and individual configuration

- Automated while still independently configurable

- Indicators and key figures according to international standards. Always up-to-date

- International calculation factors included. Up to date. Individually expandable

- Customizable evaluations

ESG-Cockpit Checklist

Toggle Accordion① System provider

- Does the provider have in-depth expertise in IT development, operation of IT solutions, data management, life cycle analysis and sustainability reporting?

- Is integration know-how available and/or is the provider dependent on support from third parties?

- Is the provider organised independently with no obligations to purchase additional services from related parties?

- Does the vendor have technology and development partnerships that will help expand the functionality of the system in the future?

- Does the provider orient itself towards sustainability standards in all business processes (fair working conditions, green IT, …)?

② Intersections

- Is the system compatible with other existing systems?

- For example, can it be seamlessly integrated into a reporting system?

- Is there a way to integrate a compliance system?

- Can the system import data via self-configurable interfaces?

- Does it require manual effort to export inputs and evaluations to Excel?

- Can diagrams and tables be exported in different formats?

③ Usability and system updates

- Do users require special skills to operate the system?

- Does system operation feel intuitive to the user?

- Is data input and output transparent and graphically supported without risk of oversight?

- Are calculation factors updated automatically as well as the latest standards?

- Is there a plausibility check that points out possible inconsistencies in the data input?

- Are data qualities and data documentation integrated at all levels as well as in input and output?

④ Configuration

- Is there a way to assign user rights precisely according to input, output and integrity requirements?

- Is it possible to create reporting periods and organizational structures individually and with graphical support?

- Can the users configurate indicators and the data catalogue (switching off substances, indicators that are not relevant in the company) independently?

- Is there a balance between automatic (e.g. one-click reports) and individually adaptable elements (e.g. self-configurable evaluations)?

- Does the system accommodate individual supplementary data (own inputs, own products/services, own key figures)?

⑤ Service/support

- Can the process be supported in all steps and aspects of data management? (In the sense of transparent reporting, sustainability strategy and management.)

- Does the provider react promptly to the wishes, needs and suggestions of customers?

- Are individual wishes taken into account and implemented?

- Is there a transparent release planning including maintenance windows?

- Is the system and any necessary support always available in a timely manner?

⑥ Mulitlingualism

- Is the user interface available in multiple languages?

- Can I switch seamlessly between languages?

- Are database contents (data catalogue) also available in multiple languages?

⑦ IT-Technology and Security

- Is the system only available as a web-based tool or can it also be installed on its own server in organization/internal networks?

- Is the system also independent of third-party providers in basic components?

- Does the IT infrastructure correspond to the current local and international legal regulation with regard to data protection?

- Is the IT security aligned to international standards such as OWASP Top 10?

- Is there a close-meshed data backup system?

ESG Funding

Different times call for different ideas. And profoundly different times require profoundly different, pioneering ideas. Do you have inventive ideas and solutions for your business rebuilding or new business? Excellent. Because our company supports such activities financially through a variety of special grants and other forms of financial support. We can offer targeted advice and support together with specialized funding experts in various fields. No one person can navigate the multiple areas of regional, national and European funding. But we know exactly who to turn to for expertise on funding support for your projects. Upon request, we survey your status and check the eligibility of your project for funding. We advise you in preparing your applications and accompany you, together with our specialists, through the entire funding project up until the final settlement.